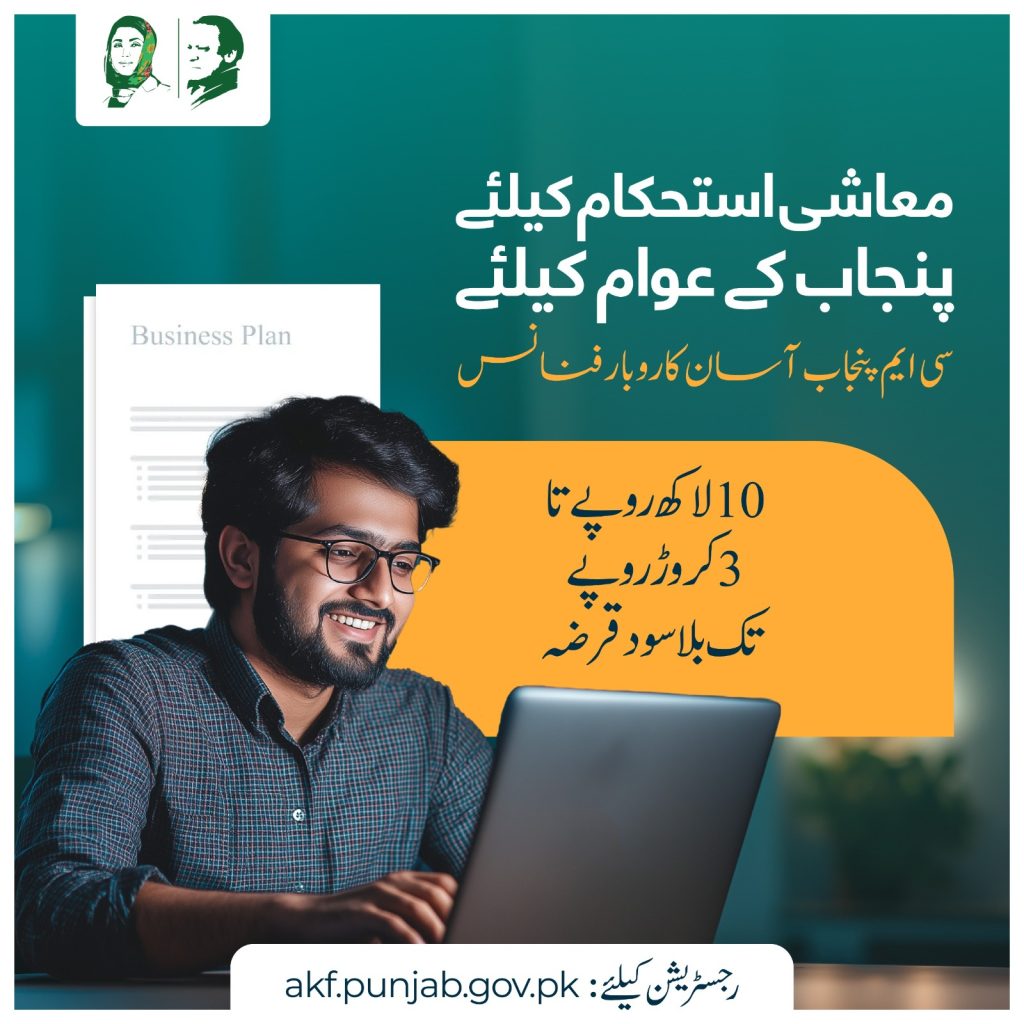

CM Punjab Asaan Karobar Program 2025 Online Registration akf.punjab.gov.pk

The CM Punjab Asaan Karobar Program 2025 is a groundbreaking initiative aimed at empowering Small and Medium Enterprises (SMEs) throughout Punjab. This program offers interest-free loans to support the start-up, expansion, and modernization of businesses, focusing particularly on sectors that are pivotal for the economic growth and export enhancement of the region. By providing financial backing, the program endeavors to spur entrepreneurship, create jobs, and promote sustainable business practices across the province. Also Check CM Punjab Karobar Card Program 2025.

Loan Purpose

Under the CM Punjab Asaan Karobar Program 2025, loans are specifically designed to support diverse business needs:

- New Businesses: Providing startup funding to encourage new entrepreneurial ventures.

- Existing Businesses: Offering financial support for expansion, modernization, or enhancement of working capital.

- Leasing: Facilitating commercial logistics to improve business operations.

- RECP Technologies: Supporting businesses that implement climate-friendly technologies to promote environmental sustainability. Also Check CM Punjab Honahar Laptop Scheme 2025 by Maryam Nawaz.

Eligibility Criteria

Applicants must satisfy the following requirements to qualify for the loans:

- Enterprise Size:

- Small Enterprises: Annual sales not exceeding PKR 150 million.

- Medium Enterprises: Annual sales ranging from PKR 150 million to PKR 800 million.

- Age Limit: Entrepreneurs should be between the ages of 25 and 55.

- Tax Compliance: Active FBR tax filers with no history of credit defaults.

- Location: Both the business and residence must be located within Punjab.

- Documentation: A valid CNIC and National Tax Number (NTN) are mandatory.

- Business Premises: Must own or rent a business location.

Loan Details

Terms and Conditions

The program offers two tiers of loans, each with specific terms:

- Tier 1 (T1)

- Amount: PKR 1 million to PKR 5 million.

- Security: Requires a personal guarantee.

- Tenure: Maximum of 5 years.

- End-User Rate: 0% interest.

- Processing Fee: PKR 5,000.

- Tier 2 (T2)

- Amount: PKR 6 million to PKR 30 million.

- Security: Loans are secured.

- Tenure: Maximum of 5 years.

- End-User Rate: 0% interest.

- Processing Fee: PKR 10,000.

Additional Financial Terms

- Grace Period: Up to 6 months for startups and 3 months for existing businesses.

- Equity Contribution:

- No contribution for T1, except for leased commercial vehicles (25%).

- 20% for other loans under T1 and T2.

- A reduced rate of 10% applies to females, transgender individuals, and differently-abled persons.

- Repayment: Loans are to be repaid in equal monthly installments as per approval terms.

- Late Charges: PKR 1 per PKR 1000 per day for overdue payments.

- Additional Costs: Varies by business type, including NIL for new businesses, 3% per annum for existing businesses under T2, and no annual fee for climate-friendly businesses. Insurance, legal, and registration fees are extra and based on actual costs.

How to Apply for the CM Punjab Asaan Karobar Program 2025

Applying for the CM Punjab Asaan Karobar Program 2025 is a straightforward process. Before you begin, ensure you have access to a stable internet connection and follow the detailed steps below to submit your application effectively through the online portal here.

Preparation Before Application

Before starting your application, prepare the following:

- Digital Copies of Required Documents: Have scanned copies or clear photographs of the following:

- A passport-size picture or selfie.

- Front and back sides of your CNIC (National ID card).

- Active Mobile Number: Ensure you have a mobile number registered under your CNIC.

- References: Names, CNIC copies, and mobile numbers of two references. These references should not be your blood relatives.

- Tax Status: Confirm that you are an active tax filer with the Federal Board of Revenue (FBR).

- Business Documentation:

- Detailed business income and expenses.

- A copy of the rent agreement, transfer letter, or registry document for both your business and residence addresses, as applicable.

- Security for Tier 2 Loans: If applying for a Tier 2 loan, prepare details of the security you will offer, such as property documents or government securities.

Application Process

Follow these steps to submit your application:

- Sign Up: Register on the Asaan Karobar portal https://akf.punjab.gov.pk/ using a mobile number that is registered in your name.

- Fill Out the Application Form:

- The form will take at least 15 minutes to complete.

- You can choose to complete the form in one session or save a draft to continue later.

- Upload Additional Information:

- Upload financial statements, business feasibility studies, and any other relevant documents that can strengthen your application.

- Application Fees:

- Tier 1: PKR 5,000 (non-refundable)

- Tier 2: PKR 10,000 (non-refundable)

- Ensure you have the application fee ready for submission with your form.

- Submit the Application:

- Once you have completed the form and attached all necessary documents, submit your application.

- The processing of your application will begin once you have paid the application fee.

- Confirmation and Updates:

- After submitting, you will receive an application registration number, which will appear on your screen and be sent to you via SMS.

- You can receive updates on your application status through SMS or check directly on the portal.

Final Notes

Ensure all information provided is accurate and complete to avoid delays in processing your application. The CM Punjab Asaan Karobar Program 2025 is an excellent opportunity for SMEs in Punjab to access financial resources crucial for business growth and innovation. Good luck with your application!

Frequently Asked Questions (FAQs)

What documents do I need to apply for the CM Punjab Asaan Karobar Program 2025?

You will need:

- A passport-size photograph or a selfie.

- Scanned copies or clear photos of both the front and back sides of your CNIC.

- Details including names, CNIC copies, and mobile numbers of two non-relative references.

- Proof of business and residence (rent agreement, transfer letter, or registry).

- If applying for a Tier 2 loan, details of the security to be offered.

How do I register for the application?

You must sign up on the official Asaan Karobar portal https://akf.punjab.gov.pk/ using a mobile number registered under your name. Once signed up, you can proceed with filling out the application form.

How long does it take to complete the application?

It typically takes at least 15 minutes to complete the application form. However, having all the necessary information and documents ready can make the process quicker.

Can I save the application form and complete it later?

Yes, the online application system allows you to save a draft of your application. You can return to complete and submit it at a later time.

What are the application fees?

- For Tier 1 loans, the application submission fee is PKR 5,000.

- For Tier 2 loans, the fee is PKR 10,000. Both fees are non-refundable.

What happens after I submit my application?

After submission, you will receive an application registration number displayed on your screen and sent via SMS. The processing of your application starts once you have paid the application fee.

How can I check the status of my application?

You can receive updates via SMS or check the status of your application by logging into your account on the Asaan Karobar portal https://akf.punjab.gov.pk/.

Are there any late fees for delayed payments after loan approval?

While the application process FAQs do not typically address post-approval details such as late fees for delayed payments, it is important to adhere to the repayment schedule agreed upon to avoid any penalties, as specified in your loan terms.

Who can I contact for help during the application process?

You should refer to the support or contact section of the Asaan Karobar portal for assistance. Alternatively, detailed contact information, such as a helpline or customer service numbers, is usually available on the portal for direct support.

What is the purpose of the CM Punjab Asaan Karobar Program 2025?

The program is designed to empower SMEs in Punjab by providing them with interest-free loans to help start, expand, or modernize their businesses, with a particular emphasis on sustainable and climate-friendly practices.

Who is eligible for these loans?

Eligible participants include SMEs in Punjab that meet specific sales criteria, age requirements, tax compliance, and other documentation standards.

How do businesses apply for these loans?

Eligible businesses can apply through designated official channels, which may include specific government platforms or authorized financial institutions.

What are the repayment terms?

Repayment must be made in equal monthly installments based on the conditions agreed upon at the time of loan approval.

Are there any additional fees or charges?

Yes, there are processing fees, potential late charges, and other costs such as insurance, legal, and registration fees that apply based on the actual expenditures incurred.

Conclusion

The CM Punjab Asaan Karobar Program 2025 offers a vital lifeline to SMEs across Punjab, providing them with the necessary financial resources to thrive without the burden of interest. This initiative is not only a boon for business owners but also a significant step towards economic sustainability and environmental responsibility in the region.

One Comment